Microfinance Information Exchange (MIX) has partnered with Kiva.org to produce a three part series to give our readers a deeper dive into social performance! The series, written by the MIX, will be released weekly for the next three weeks. This first post discusses why tracking social performance indicators matter.

Microfinance institutions (MFIs) today operate in a more challenging environment than ever before. High levels of competition – both for clients and for funding – the pressure of commercialization and the related pressure to grow as quickly as possible all serve to distract an MFI from what should be its top concern: making life better for its clients. This social aspect of microfinance differentiates it from traditional, profit-driven financial services. Nevertheless, it can be very difficult for an MFI to stay true to its social mission, especially as the boundary between microfinance and traditional finance continues to erode.

In response, an industry consensus has emerged regarding the importance of “social performance management” (SPM). SPM seeks to ensure that an MFI’s systems and processes are properly aligned with its social mission and that the MFI is indeed creating positive changes in the life of its clients. . The Social Performance Task Force (SPTF) was founded in 2005 to define, measure, and improve the social performance of MFIs. Since 2009, the Microfinance Information Exchange (MIX) has collected social performance data from MFIs, including many Kiva Field Partners.

How do social performance metrics work in practice?

Social performance metrics focus on things like social responsibility to clients, to staff and to the community in which an MFI operates. To see how this works in practice, let’s take a closer look at the area of SPM known as “social responsibility to clients” and examine the case of an MFI whose mission is to provide affordable finance to the poorest members of its community. To achieve its goals, this MFI must design products that are appropriate to the needs of its target clients. At the same time it needs to ensure that customers have sufficient capacity to repay loans without becoming over-indebted. Furthermore, the MFI’s operations must also be as transparent as possible so that clients can understand the terms of its various products.

However, it is one thing to enact a certain policy and another to implement it effectively. This is where measurement becomes important. To help an MFI ensure that its operations are effectively conforming to such policies, MIX and the SPTF have designed a “social performance pathway” composed of practical indicators that can be easily tracked and monitored over time.

Examples of such indicators are:

· The level of board involvement in monitoring progress towards the MFI’s mission.

· The products and services – both financial and non-financial – designed specifically to target the poor.

· The type and degree of social performance goal-related staff incentives, such as rewarding employees who attract new clients from the MFI’s target market or the quality of their interactions with clients.

Other aspects of measuring social responsibility to clients include tracking whether an MFI has implemented any consumer protection principles, whether it monitors client retention rates, and whether it uses poverty measurement tools to track the income or well-being of entering clients and the way these change over time. Poverty measurement is a crucial and oft-neglected (yet sometimes very expensive) step that MFIs can use to target the most underserved clients and to verify whether their circumstances are in fact improving. Examples of these indicators are:

· What percentage of entering clients are poor?

· What percentages of male versus female clients are poor?

· How does this year’s poverty rate compare to last year’s?

Our example MFI would then use the information it has collected to reassess its mission and improve any operational weaknesses it finds.

What other social performance initiatives exist?

All social performance indicators are geared towards maximizing the amount of good MFIs do while minimizing any harm. As such, proper SPM is something that cannot happen all at once: MFIs need to set priorities regarding the areas on which to focus. Fortunately, they are not alone when it comes to implementing proper SPM and a wide range of initiatives exists to help them: MIX offers trainings on the various social performance indicators. Institutions can report interest rates to MFTransparency and sign on to consumer protection principles by endorsing the Smart Campaign. CERISE provides an internal social audit tool, compliant with the MIX indicators, which can help MFIs evaluate their performance before reporting to MIX. Finally, Grameen Foundation’s Progress out of PovertyTM (PPI) tool and USAID’s PAT – two simple and accurate means of measuring poverty incidence – are available in over 30 countries with benchmarks for local conditions and international poverty lines.

Kiva’s commitment to social performance

Kiva takes its commitment to social performance and responsible microfinance very seriously. To that end, all Kiva Field partners must comply with the following:

• Endorsement of the Smart Campaign’s client protection principles;

• Implementation of a client waiver by which Kiva borrowers are made aware of and given the opportunity to consent to sharing their information on Kiva’s website;

• Definition of a core “Reason Why We Work” with each Field Partner in line with our best thinking on catalytic microfinance interventions;

• Conducting social audits with CERISE’s SPI tool every two years to understand together with our Field Partners what are their strengths and areas for future focus;

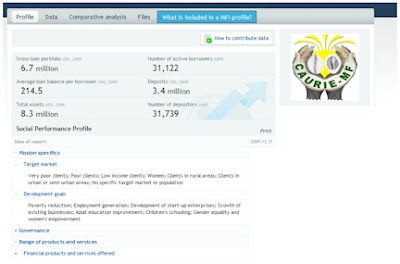

• Encouragement to report social performance information to MIX Market for online publication (see example of Caurie Micro Finance below).

PREVIOUS ARTICLE

Kids Get Their Day →NEXT ARTICLE

Microlending Behind the Scenes: How MFIs Judge Credit Worthiness →