Note: This post was published in 2009 and contains outdated information. Please see this blog post or kiva.org/help.

By Zev Lowe, KF 8 Indonesia

The US dollar has recently risen significantly against many currencies. When I arrived in Bali to begin my Kiva Fellowship with DINARI Foundation, I received 10,295 Indonesian Rupiah (IDR) for each of my US dollars. This is 10% higher than a year ago, when the US dollar was worth 9,350 IDR.

How does this fluctuation in exchange rates affect Kiva lenders, partners, and borrowers? Does this mean that an Indonesian farmer or food vendor is left having to bear the burden of the strengthening dollar?

Kiva Field Partners deal with currency risk on Kiva loans

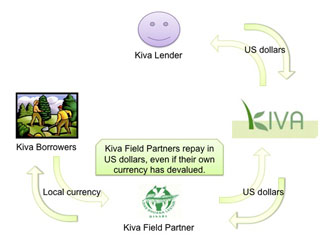

As a Kiva lender, your money gets sent in US dollars to a Kiva field partner, like the one with which I am working, DINARI Foundation, in Bali, Indonesia. Among other things, Kiva field partners work tirelessly to examine and approve loan applications, go into the field to meet borrowers and collect repayment, and often provide non-financial assistance like education and sometimes healthcare. The Kiva field partner exchanges the funds into local currency and passes them along to the Kiva borrower. The Kiva field partner then converts the borrower’s repayments into US dollars and sends back to Kiva.

This leaves Kiva field partners with the potential to lose quite a large sum of money as currencies fluctuate. To illustrate, the blue line in the graph below shows you how many Rupiahs you could get for 1 US dollar at any point in the last year. I’ve sketched out the implications of the exchange rate on an imaginary a $1000 interest-free loan. The repayments should be in 10 equal installments of $100, but as you can see, if you operate in Indonesian Rupiah, the amounts are anything but equal, ranging from 910,000 IDR to 1,210,000 IDR.

By the time May rolls around, the initial amount disbursed ten months prior in local currency (9,150,000 IDR) is no longer worth a thousand US dollars — rather, given current exchange rates, it is worth only 871 US dollars. Due to currency fluctuations, the entity responsible for this imaginary loan will be paying what amounts to an 18% premium over 10 months. And that’s on an interest-free loan!

I’m glad that Kiva borrowers are currently completely insulated from the reality of foreign exchange movements. But this leaves Kiva field partners paying thousands of dollars every month to compensate for currency fluctuations. For those of you who are finance people, larger Kiva field partners that operate in liquid currencies can hedge their foreign exchange exposure. But this still leaves smaller Kiva field partners extremely vulnerable.

As a Kiva lender, with so many currencies devaluing against a strong dollar, I find myself asking what more I can do as a lender and as a Kiva Fellow so that the responsibility of foreign exchange risk does not land solely on the shoulders of our dedicated and hardworking Kiva field partners.

***

Zev Lowe started work at DINARI Foundation today. He recently completed his MBA at ESADE Business School in Barcelona, Spain. Zev loves finance, technology, Aikido and long walks on the beach.

/>