Recently, I had the opportunity to learn how teachers are using Kiva to teach their students about finance and global development. My expert source: Kristen Goggin, a 6th grade teacher at San Francisco's Town School. Check out our interview with her below.

How did you discover Kiva?

In April 2011, I attended the Global Education Conference at La Jolla Country Day School in San Diego. A Kiva booth was set up there, and I learned more about Kiva and its global message.

Goggin, far right, with Kiva CEO Matt Flannery and some of her students.

How do you teach microfinance to your young students?

Goggin, far right, with Kiva CEO Matt Flannery and some of her students.

How do you teach microfinance to your young students?

I start the school year by assigning the book One Hen that teaches students how one loan can make a big difference to help an individual as well as their community.

In addition to reading the book, we learn about microfinance and how just $25 can change a life. We began our loan process last year with Grace from Ghana. She cooks food for a local school, and my students really connected to her story.

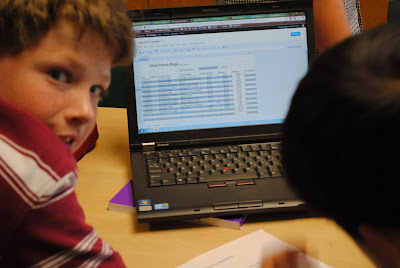

Students talk about their Kiva experience.

How do you make microfinance part of your curriculum?

Throughout the last school year, we made 34 loans across 18 countries: 32 on Kiva and 2 with Kiva Zip (still in its pilot phase). We also created our own Kiva Marketplace. The students formed teams and created their own business plans. The five teams raised "loans" to sell products to the upper and lower school students at a profit.

The teams sold bracelets, stunner shades, pins, custom stickers and Town School lacrosse bands. The money from their sales enabled them to pay back their lenders, and they used their $300 in additional funds to invest in Kiva borrowers.

How do you make microfinance part of your curriculum?

Throughout the last school year, we made 34 loans across 18 countries: 32 on Kiva and 2 with Kiva Zip (still in its pilot phase). We also created our own Kiva Marketplace. The students formed teams and created their own business plans. The five teams raised "loans" to sell products to the upper and lower school students at a profit.

The teams sold bracelets, stunner shades, pins, custom stickers and Town School lacrosse bands. The money from their sales enabled them to pay back their lenders, and they used their $300 in additional funds to invest in Kiva borrowers.

Why is it important to teach microfinance principles to students at a young age?

The values that the students learn through microlending are very important to their 21st century education. They learn about empathy, collaboration, teamwork and civil responsibility. Many times, we would reflect on how Grace, our borrower, would handle herself in a situation.

We're going to start the school year making comparisons between the U.S. and countries Kiva invests in. The students will research and create an advertising campaign on why to invest in their chosen country.

We're planning on implementing a Kiva Marketplace again too. My past students will become part of a "Kiva Council" that will advise the new students on their business plans.

We're planning on implementing a Kiva Marketplace again too. My past students will become part of a "Kiva Council" that will advise the new students on their business plans.

Kiva CEO Matt Flannery came and spoke about the Kiva Zip program to our students last Spring. I hope that our students have the opportunity to loan more through Kiva Zip soon. It would be great for the students to potentially meet their borrowers and see their loans' impact firsthand.

PREVIOUS ARTICLE

Back to School: Campolindo Cougars have Kiva spirit! →NEXT ARTICLE

A Photo Contest, Kiva Training and Some Light Audit Work →