Home • Microfinance • Article

A Day in the Field filled with Stories and Smiles

November 4, 2013

Navigating Dar es Salaam

Our first task of the day was to navigate our way to the south of town to meet with a group of Kiva Borrowers. Getting around in Dar es Salaam is no easy task. For me, it always feels like an adventure. I have great respect for the loan officers, staff at Tujijenge, borrowers, and everyone else that travel great distances each day to do their job. Dar is the 9th fastest growing city in the world and one needs to look no further than the roads to see proof.

Traffic in Dar

Traffic in DarThe public buses, called dala dalas, are extremely overcrowded with people standing 2 wide in an aisle that barely fits one person and everyone is piled on top of each other. The concept of personal space is thrown out the window and this is coming from a regular NYC subway rider. I heard the dala dalas were a gift from Korea and were most likely built for a smaller frame. I have had occasions where my legs actually do not fit in the space provided for legroom. I have also had times where I need to duck if I do not get a seat because the ceilings are not high enough for me at 5’10’’. When the bus is moving there is a breeze from the windows but that also invites in all the dusts and exhaust from the other trucks not to mention is it very very hot so people can get a little sweaty. The cost for a ride is between 400 and 600 Tanzanian shillings or about $0.30. I have found that no matter what time of day I travel, we get stuck in traffic jams and can be at a standstill for 30 minutes until the traffic cop points to our sections and waves us on. The dala dalas have found ‘clever’ ways around this like driving on the side of the road or dirt sidewalks but eventually they get stuck and need to merge back onto the road.

Empty Dala Dala

Empty Dala Dala Inside Dala Dala before it gets packed -notice legs in the aisle because they don't fit

Inside Dala Dala before it gets packed -notice legs in the aisle because they don't fitSo that is how our day began. Rita, the Kiva coordinator, and I boarded a dala dala to go meet with our first group. I am very thankful Rita joined me on this journey because I would have never found my way on my own. 3 buses, 1.5 hours, and approximately 13 miles later we arrived at our destination. We traveled only a little faster than it would take me to run that distance. Rita and I stopped at a market to wait for the loan officer to guide us to the group meeting spot. While we waited, we enjoyed the water inside a a nice fresh coconut and I took a few moments to soak in the surroundings. It was an experience for all senses and I had an 'I am really in Africa' moment.

· the sight of colorful clothing from women and kids in their school clothes enjoying a snack after school

entrepreneurs with their small stands selling a range of different everyday items including a variety of fruit, snacks, and charcoal

motor cycles waiting to transport people from the bus stop to smaller places the buses cannot go

Village outside of Dar Es Salaam

Village outside of Dar Es Salaam· the sounds of people making a living or enjoying the company of others, laughing, horns honking, trucks driving by, food frying, people exchanging greetings

· the smell of a market - fried chicken, exhaust from the buses and motorcycles, the pungent smell of fish and sweat mixed with the sweet smell of frying donuts

· the taste of the fresh coconut water followed by the meat inside the coconut

Rita buying a coconut for a drink and a snack

Rita buying a coconut for a drink and a snack· the feel of a welcome breeze from the heat combined with dust on my skin.

Group Meeting

The loan officer found us (I was not hard to spot as the only non-African in the area) and walked us back to our first group meeting of the day. We were meeting with Songa group. All the borrowers from Tujijenge on Kiva currently are part of a group loan. The members of the group can take out different amounts and can have different maturity dates. People form their own groups and create a group name and each person might have a different type of business. I have participated in many group loan disbursements and have been amazed to see people take as little as $50 for their first loan to up to $1200 for a 10th loan as they proved the ability to repay and their business has grown. The concept of a group loan gives people access to finance that would not have traditional collateral to guarantee a loan since the group members guarantee each others' repayments.

Songa group meeting

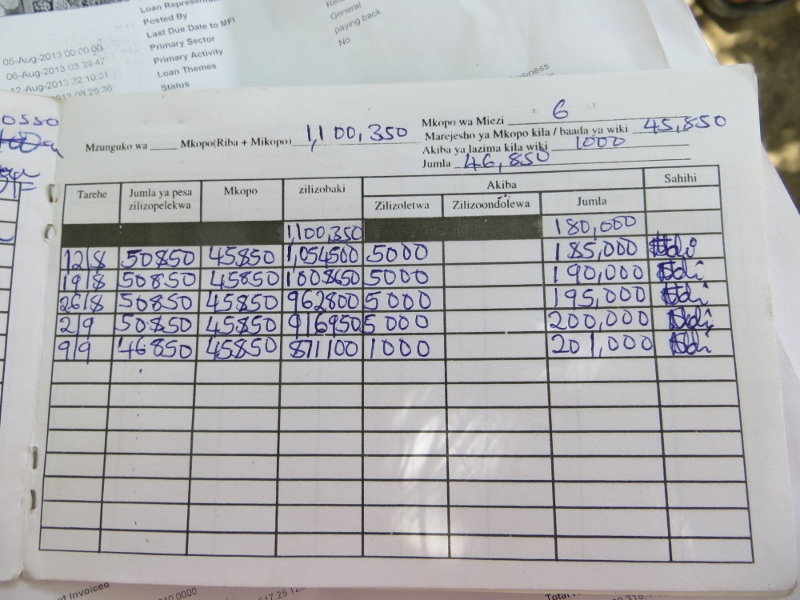

Songa group meetingThe groups usually meet every other week and the loan officer attends these meetings. Since the meetings are during the work day, sometimes member cannot attend and will send a repayment with another member or meet up with the treasurer separately. The treasurer of the group collects everyone’s repayments and marks it down in the group notebook which acts like a ledger and also marks it down in the individual passbooks. The passbook has a photo of the borrowers on the front and then repayment and loan details inside. The loan officer is there to confirm and sign off on the repayments and talk to the group about any questions or issues. Ashura is the featured borrower in Songa and she used the loan to buy supplies for her beauty salon , but her business was far from the meeting spot. Two of the other members however had a business right next to the meeting spot so I asked if I could see their business and learn a little about it.

Tracking repayments in a Passbook

Tracking repayments in a Passbook Leah working in her salon

Leah working in her salonLeah was the first person that offered to show me her shop. Like Ashura, she has a beauty salon. Leah has used loans over the years to first open and then expand her business. Her shop has 3 professional hair dryers and she bought those with loans. Leah is very happy with her loan because she is able to make an income to help her cover expenses. She had a client while we were waiting and the client looked very pleased with her new hairstyle.

Helena in her drink shop

Helena in her drink shopHelena has a drink shop right next to Leah’s salon and that was my second stop. She sells soda, water, and beer. She used her loan to restock drinks. Helena is thrilled with her loan because it allows her to run a business and have some money to cover household expenses. I bought several sodas from Helena and everyone sat down in the shade and enjoyed a cold drink and shared smiles. It was great to be able to connect the entire loan cycle – a $25 loan sent via Kiva to Songa group where Helena was able to re-stock her sodas and then I was able to buy a few sodas to share with the group – a successful and satisfying morning, but our day was not over yet. Rita and I still needed to trek across town to meet with another group.

That journey took us 2 hours, 3 buses, and a bajaji (a tuk tuk) and we covered approximately 18 miles. We were in an area north of town near a beach. The loan officer, Magdalene, met us and walked us back to where the group was meeting. It was an interesting mix of worlds with enormous houses for the very elite surrounded by large fences on the outside and then small little areas set up for the workers of the house to live and some basic small shops for their needs.

Group meeting near small shops with larges houses in the background

Group meeting near small shops with larges houses in the background Mary in her pharmacy

Mary in her pharmacyIt was here that I met Mary. Mary is in her forties, and is married with three children who are in school. She has operated a pharmacy shop since 2008. She works from 8am to 8pm daily and she is able to make a monthly profit to help with school fees and household expenses. Mary used her loan to buy medicines to sell in her shop. The name of her shop is Peace and Medics and I enjoyed looking at the different items she sells.

After we left Mary we walked for about 10 minutes with Magdalene to meet one more group that I had to meet with for a borrower verification. It was 5pm and Magdalene had been out all day and it was hot and dusty and she had not had any time to eat lunch – a typical day for a loan officer. After our meeting she still had to go back to the office before making the long journey home. We parted ways and Rita walked me to the bus stop to head back home. This was a direct shot and I knew my stop so she let me go on my own but made sure to tell everyone around me in Swahili the stop I needed to get off on and to help me. She also called me 5 minutes into the journey to tell me the stop name again.

One of the reasons I applied for the Kiva Fellows program was to get out of my cube and see microfinance in the field and today I accomplished that and more. It ended up being more than just 'seeing' microfinance. I was sharing stories, smiles, sodas, and learning about businesses, hard work and sacrifices. It was a great day and I felt fortunate to have this opportunity. And it was even more amazing to think that all these stories and smiles are possible because of Kiva lenders loaning as little as $25.

Please help continue to create stories and smiles in Tanzania but supporting Tujijenge's current loans

Songa group

Songa group