Small U.S. business owners and borrowers backed by Kiva tell their stories

April 6, 2020By: Rachel Phandinh

Kiva has always stood as a community for doing good and paving the way for universal financial inclusion. At Kiva, we work towards breaking down the barriers that prevent people from gaining access to capital, resources and more. On the other side of the equation, Kiva would not be where we are today without our borrowers and lenders.

Starting a small business proves to be a challenging, yet extremely rewarding experience. We want to celebrate just some of the risk-takers amongst our borrowers across the states!

Meet Scott, a business owner and borrower from Pennsylvania.

Scott is the owner of a construction company that offers renovation and repair services for residential and commercial properties. As a labor worker, he experienced first-hand the injustice within the construction sector. This stuck with him and fueled his passion to start his own business. Scott wanted to alleviate inequality of the overall development in the residential and commercial sectors within the Pittsburgh area. People were getting charged unfair prices for work that was not equivalent to its expected value.

“My motivation to become a successful business owner is connected to three major aspects of my life: community, family, and personal freedom.”

Scott used his loan to develop and grow his business. He even was able to add two skilled carpenters to the team. His company’s goals are to continue scaling the business to help as many people as they can.

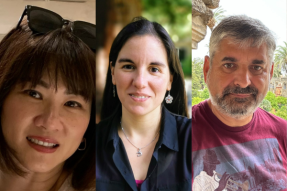

Meet Toni and Sheila, a mother-daughter dynamic duo and small business owners.

From Toni’s earliest memories, Saturday afternoons always meant family bonding and the scent of freshly baked cookies, which always filled Toni’s heart and stomach with joy. One day, Toni and her mother, Sheila, realized there was no one in the market making cookies fresh or on-site. This, coupled with their philosophy on eating healthy foods and holistic health, proved to be the foundation in establishing their gourmet cookie shop. Their business specializes in making all-natural homemade cookies, brownies and ice cream - all made from scratch and by hand.

“It makes us smile when our customers walk in and see us preparing our products from scratch and right before their eyes while the aroma of cookies baking is in the air.”

Toni and Sheila’s biggest challenge has been having enough working capital to take care of all expenses that are involved with owning a business. They work tirelessly to provide all that they can for their loyal customers and the community. With their $5,000 Kiva loan, Toni and Sheila purchased quality ingredients, uniforms, display cases and more to help improve their business.

Meet Luke, a family man and farmer from Indiana.

After getting married, Luke and his wife decided to start their newlywed life with vegetable farming. They wanted to raise a family within nature to truly understand and build a relationship with the land. Luke’s farm consists of his wife, three kids, 20 acres, fruit trees and more than five species of farm animals at a time. As time goes on, his farm grows more diverse, abundant and regenerative.

“We are proud that we have been able to shift and grow our business to provide more nutrients and calories, more sustainably, and more efficiently than ever before.”

Luke and his family sought out a Kiva loan in order to start raising sustainable pork. Since then, they have more than tripled production of pork and added pastured chicken and grass-fed lamb to the farm as well.

Meet Carmen, a mother and florist from California.

Guatemala-born, Carmen immigrated to the United States at the age of 8 in hopes of a better life for her and her family. In order to help her family out financially, she worked in retail for a few years. Upon giving birth to her son, she found herself working at a local flower shop. Carmen had always dreamed of becoming a successful businesswoman and knew she had what it takes.

“I worked at the flower shop for 8 years, before I was fortunate enough to become the shop’s owner. The flower shop has proved to be a beneficial way to help my family."

As the new owner of the flower shop, Carmen knew there were improvements to be made. Using her Kiva loan, Carmen invested in a delivery van since the business was heavily dependent on the safe transportation of floral arrangements for clients. As a result, she was able to greatly enhance the business’s efficiency and attract new customers.

From borrowers to lenders to and partners, we’re grateful for everyone in the Kiva community who are involved in every step of the way!

For entrepreneurs and small U.S. business-owners, apply for a small business loan.

Join us in supporting small U.S. businesses. Make a loan, today!

PREVIOUS ARTICLE

A strong-willed woman and her storefront: Elpidia's story →NEXT ARTICLE

From lender’s wallet to farmer’s pocket: The journey of a loan →