How can one person positively impact global poverty? Kiva lender Colleen thinks back to a quote from South African human rights champion Desmond Tutu:

“How do you eat an elephant? One bite at a time.”

That’s how Colleen views the 133 small loans she’s made on the Kiva platform since 2015. Following the philosophy of Desmond Tutu, each loan addresses the giant issue of financial exclusion, bite by bite. A teacher’s aide for special needs students in Sydney, Australia, Colleen came across the concept of crowdfunded microfinance while looking for a way to direct her own funds judiciously and effectively.

“I became a lender after reading a news article which had ratings for various charities, and Kiva was so well-rated I sponsored one lender essentially to see if the system worked,” she recalls, adding that it helped that the Australian dollar was almost on par with the US dollar.

“Kiva has made it possible for me to make charitable contributions globally.”

By depositing a total of US $751 over the years, Colleen has lent out a total of $3300 by relending each loan repayment. She counts that as an excellent return that has put good use to her contributions that come out of her teacher’s salary.

“I work hard for my money so it needs to work hard for me!”

Learn more: How Kiva works

Witnessing poverty as a child

“You’ll often hear people say, ‘money can’t buy happiness.’ Well, it can buy you food and a roof over your head, which is a happiness denied to many people.”

Colleen has been familiar with both Tutu and the need for financial inclusion in developing countries since she was a child growing up in Butterworth, South Africa.

“I come from the Eastern Cape, the poorest province in South Africa, where seventy percent of people live below the poverty line,” she says of the mountainous district where many citizens survive by subsistence farming.

“Most of the money people earn goes to put food on the table. It’s your first, most basic need. If you can't feed yourself, you can't do anything else.”

One of the oldest white settlements in the former Transkei region designated as a Black homeland during the apartheid years, Butterworth remains underdeveloped with widespread unemployment and limited access to healthcare and other basic services.

“The poverty is still ongoing from the legacy of apartheid, and the education system hasn't caught up at all,” laments Colleen, whose mother and sister still live in the Eastern Cape.

After she finished her education and got married, Colleen traveled all over the world with her ex-husband, including a four-year stint in Zimbabwe, where her youngest child was born. There she witnessed more instances of people struggling with food insecurity and a shortage of economic opportunity.

“There's so many that don't have the basics to no fault of their own, not through lack of trying,” she observes.

“It's just the circumstances.”

Lend to a borrower in Africa today

Lending to women and farmers, closing the gap

Colleen made her first ever loan in 2015 to Lina, a saleswoman in Mozambique.

Colleen made her first ever loan in 2015 to Lina, a saleswoman in Mozambique. Colleen supports small farmers because they are less likely to receive capital from traditional banking institutions, due to the inconsistent cash flow of farming. However, she says, a borrower’s geography and personal story also play a large part. She has made loans in 36 countries, most of which are on the African continent, “simply because there is a lot of opportunity to lend.”

Her first Kiva loan was to a woman in Mozambique, Lina, who was setting up a business buying and selling secondhand clothing and needed capital to purchase inventory of blankets and clothing. Secondhand clothing sales are a common enterprise in Africa, fomented by the developed world’s cast-off fashions.

“I hope her life has improved because of it,” she says.

Colleen is also a mother of three, and continues to lend primarily to women. In fact, 70% of the loans she’s made have been to women.

“Women head up a lot of households in Africa,” points out the education specialist.

Globally, women earn at least 20% less than men and spend many more hours on necessary, unpaid labor, like housework. Gender equality is an important pillar of progress as a society, and making capital accessible to women is one way of reaching that goal.

Further reading: Why gender equality is so important

The joy of supporting individual borrowers

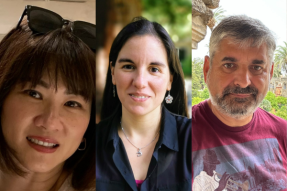

Kiva loans help borrowers like Ledis, who runs her own grocery store.

Kiva loans help borrowers like Ledis, who runs her own grocery store. Once a month, Kiva sends an email to keep her apprised of how her loan portfolio is faring. She’ll then relend any repayments and add a few more dollars to “top it up.” What she refers to as “incremental amounts” of money doesn’t diminish the enthusiasm Colleen brings to seeking out new borrowers, and she takes her time reading through each profile.

“Every now and again, I think, ‘Oh, I could just donate the total sum,’” she says.

“But I quite enjoy having a say who the money goes to.”

Recently, she received the news that one of her borrowers, of the 133 total borrowers she’s supported, had defaulted on their loan. This caused her no consternation whatsoever.

“I accept that, it’s part of the risk of being a lender,” she says with a shrug of Kiva’s low default rate where 96.3 percent of all loans are repaid in full. “Let it go.”

Learn more about how Kiva protects clients and prevents overindebtedness here.

A more equitable system

“Those of us who have had more opportunities should do what we can to enable those with little opportunity.”

Colleen extols Australia’s universal healthcare and education programs that help balance the socioeconomic challenges of her country, though she acknowledges that no single country has a model that can solve the issue of global poverty.

“We need a more equitable system,” she says of the world’s disproportionate wealth allocations.

“Those of us who have had more opportunities should do what we can to enable those with little opportunity.”

That doesn’t mean the community-minded educator suggests we do away with financial currency altogether.

“You know, don’t knock money!” she admonishes.

“You’ll often hear people say, ‘money can’t buy happiness.’ Well, it can buy you food and a roof over your head, which is a happiness denied to many people.”

The massive elephant of global poverty and financial exclusion continues to challenge billions around the world. By lending to individuals on Kiva, Colleen knows she is contributing to the solution, one bite at a time.

“What is small to us makes such a difference to others,” she encourages.

“Everyone has the right to earn a living and support themselves and their family.”

PREVIOUS ARTICLE

How Kiva loans helped Rosa invest in her life and land—and become a leader for women in her community →NEXT ARTICLE

Catherine is a skilled artisan from Ghana. A Kiva loan helped her grow her business and teach the trade to others. →