Around the world, the lasting impact of the COVID-19 pandemic goes far beyond inundated hospitals and widespread travel bans. For small businesses in the Philippines, the challenges that owners face in keeping doors open continue to be immense, especially for those in rural areas.

In 2020, business owners were forced to let a huge percentage of their workforce go, with the World Bank reporting a 52% job loss in the construction sector and an even higher number among workers in small businesses like laundry, hairdressing, and other roadside shops.

To learn more about how the pandemic is affecting small businesses in the Philippines we interviewed Horton Caguingin, a Kiva Coordinator for Kiva Field Partner Alalay sa Kaunlaran, Inc (ASKI).

Established in 1986, ASKI is a non-profit dedicated to promoting and developing micro and small-to-medium enterprises and the delivery of social services across the Philippines. Horton’s work as the liaison between Kiva and ASKI provides him with a unique perspective on the challenges that business owners across the Philippines have been facing, as well as what has been helping them stay afloat amidst a world crisis.

Interested in supporting small businesses in the Philippines? Microloans have helped business owners during periods of closures and lower demand. You can help crowdfund small loans to people in the Philippines here.

How Horton facilitates Kiva loans at ASKI

Horton started his journey in microfinance as an Accounting major at university and began his internship at ASKI shortly afterwards. He worked his way up to an accounting assistant, and finally to a Resource Mobilization Officer, taking over ASKI’s Kiva account. Over his 4 years as a Resource Mobilization Officer, Horton has developed a deep understanding of ASKI’s microfinance recipients, including their journeys, struggles, and successes.

“I’m essentially the leader of Kiva’s ASKI team and oversee three officers in designated regions. We upload client stories on the website, and I review them before they are sent out. I also facilitate the repayment report that is submitted to Kiva monthly."

"With the help of microfinance, we can help clients’ children with their schooling.”

The impact of COVID-19 on business owners

The Philippine government passed numerous laws to aid in the well-being of citizens during this crisis. Emergency subsidies were disbursed to people across the Philippines, but unfortunately these weren’t enough to cover the cost of living. Horton speaks to how business owners have been reevaluating their strategy to support themselves and their children:

“Aside from financial support and social services, ASKI also helps clients to market their products online. Online business has been a trend in the Philippines since quarantine started and the Philippines’ Travel and Tourism sector was severely affected. Education has also been affected in the Philippines. The government is promoting online classes, but it’s tough for less fortunate families to afford the gadgets and internet required to use them. Families use their money to buy necessities, like food, instead. With the help of microfinance, we can help clients’ children with their schooling.”

Fund a microfinance loan in the Philippines

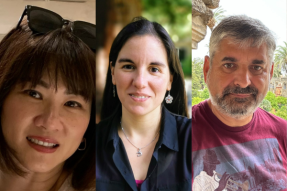

Horton with his colleague at work in the Philippines.

Horton with his colleague at work in the Philippines.The impact of COVID-19 on ASKI

Prior to the pandemic, ASKI brought financial services to underserved communities around the Philippines. Additionally, like many of Kiva’s Field Partners, they provide social services to their clients, offering scholarships for students, day care centers, and health services.

Learn more about Kiva’s Field Partners

“In March 2020, the president of the Philippines issued an executive order for enhanced community quarantine,” Horton says. This lockdown affected many cities, including ASKI’s areas of operation. “Many establishments, government offices, and institutions were temporarily closed. Public transportation was not allowed to operate, and people were restricted from going outdoors.”

COVID-19 placed microfinance institutions like ASKI in a uniquely difficult position. Since many businesses and other establishments were forced to shut down or greatly reduce their operations, a large percentage of ASKI’s clients were unable to make loan repayments. This was a sentiment heard around the country and the world, and resulted in the Philippine government implementing a loan moratorium. The moratorium was a necessary lifeline to millions of citizens living in the Philippines, but it also meant that microfinance institutions didn’t have the same financial capital they needed to support their own employees. This makes Kiva an especially crucial investor to ensure the endurance of microfinance institutions like ASKI.

Despite reduced working hours, no ASKI employees were laid off due to the pandemic. This speaks to the resilience and adaptability of the microfinance sector. With help from Kiva and other global investors, ASKI was able to pivot their strategy to focus on social services.

Learn more: how microfinance stayed resilient through a global pandemic

Finding hope during a crisis

Horton is optimistic for the future of the Philippines. With partnerships from the government and other organizations like Kiva, he is positive that recovery is close. In fact, as of March 2022, ASKI has been able to pay off all outstanding loans back to Kiva. He is grateful for the support the Philippines has received from organizations around the world, and is confident that microfinance can help small businesses around the Philippines flourish.

To learn more about ASKI, click here. To support borrowers and Field Partners in the Philippines, click here.

PREVIOUS ARTICLE

She had the will: All Thacienne needed was the way →NEXT ARTICLE

How microfinance providers can improve outcomes for women entrepreneurs →