In times of crisis, gender often becomes sidelined as a secondary concern. But as with other social, political, and economic crises of the past, the COVID-19 pandemic has deeply gendered implications.

Public health emergencies, particularly in the developing world, often disrupt gender-based violence prevention services, sexual and reproductive healthcare services, and other programs that support women and girls. Women are also more likely to be engaged in informal, low-wage, and migrant work, resulting in large and disproportionate negative impacts on their livelihoods when economies contract.

Kiva and its lending partners have long worked to tackle the gender finance gap, with 80% of loans on Kiva.org funding female borrowers. Now, partners are reinforcing this commitment with gender-specific products and strategies aimed at helping borrowers and their businesses survive these unprecedented times.

Pivoting to Essential Services

Fundación Namaste Guatemaya is one partner doing just that. This Guatemalan non-profit provides microloans, financial literacy training, and business development courses to help women jump-start or improve their businesses. The foundation has adapted its existing loan products to help female borrowers sustain themselves through economic downturn by reducing interest rates, extending grace periods, and ramping up technical assistance and business counseling services.

Specifically, Fundación Namaste Guatemaya is helping borrowers pivot from non-essential businesses to essential businesses so that they can continue earning revenue and supporting themselves and their families.

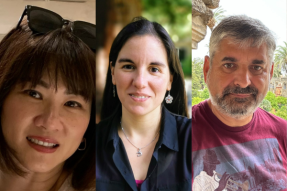

One of the foundation’s clients, Magdalena, has received three loans to date for starting and growing a business focused on creating and selling woven garments traditional to her region. Since the onset of COVID-19, Magdalena has been unable to travel beyond her home to sell her products, limiting her sales severely and leading her to pivot from clothing to tamales and other foods. With Fundación Namaste Guatemaya’s help, she hopes to overcome profit losses until she can return to her clothing business.

Getting Back to Business

In Israel, Koret Israel Economic Development Funds (KIEDF) facilitates financing for small and micro businesses and increases socio-economic opportunities for low-income and marginalized populations. It has responded to the hardships imposed by COVID-19 with a new “Back to Business” loan product that provides vital support to hundreds of women.

These loans enable borrowers to pay for ongoing orders and supplies and assists them in preparing to reopen their businesses as restrictions are lifted.

One entrepreneur who has benefited from KIEDF’s emergency loans is Mahadiya, a woman from Ein Mahel, Israel who had to shut down her at-home daycare during the COVID-19 crisis. KIEDF’s loan helped Mahadiya cover ongoing expenses and survive the economic strain of lost revenue, setting her on a viable path to reopening her daycare once conditions allow.

Going Remote

In nearby Jordan, Microfund for Women tackles gender inequality and financial exclusion by providing financial services to low-income, small business owners — especially women — in underserved communities. Microfund for Women has designed a number of new remote trainings and learning opportunities to continue engaging with its clients and staff while on lockdown. It has gone beyond its core focus on microfinance to make a healthcare app available to its clients for a fraction of the app’s usual price. Through this app, clients can consult remotely on health issues for which they can no longer see a doctor in person and receive a virtual screening for potential COVID-19 symptoms.

Paying it Forward

Another Kiva partner, CAMFED Ghana, forms part of a pan-African movement working to revolutionize girls’ education through a multiplier effect. Girls who receive support to attend school join the CAMFED Association of young women leaders. In turn, members of the Association each support the educations of an average of three more girls through their individual and collective philanthropy.

In the wake of economic devastation brought on by COVID-19, CAMFED Ghana developed a recovery loan product that provides economic support to viable businesses run by the young women of the CAMFED Association. As with previous loans funded by Kiva, CAMFED Ghana’s borrowers pay a “social interest” on their recovery loans through volunteer efforts to enhance the quality of education in their local schools. Under this commitment, borrowers contribute a minimum of 2.5 hours of volunteering per week to help students develop skills in decision-making, problem-solving, leadership, entrepreneurship, communication, and empathy.

Abibata and Mavis are two Ghanaian women who have benefitted from CAMFED Ghana’s COVID-19 response efforts. In 2018, Abibata received a Kiva loan of $125 to begin selling grocery items in Ghana’s Nanumba North district. With a second loan of $200, Abibata acquired a storefront and increased her inventory. Now, she has requested a loan to diversify her business to include production and sale of liquid soap at affordable prices for her community. In the Oti region of Ghana, Mavis leads a soap, detergent, and beauty care production business. She will use her recovery loan to purchase materials in bulk and acquire equipment for mass production and distribution of sanitary products.

In addition to meeting an increased demand for sanitary products in their country, Abibata and Mavis are giving back to their communities by providing mentorship and skills training to vulnerable children.

Focusing on women while designing recovery efforts is key to creating more resilient and sustainable solutions. These organizations understand the efficacy of investing in women and represent just a small sample of Kiva partners that have redoubled their efforts to do so during this global crisis.

You can make an impact for borrowers and Field Partners struggling under the effects of COVID-19. Contribute to Kiva’s COVID-19 Response fund today.

For more information on this subject, check out CARE’s policy brief on the gendered implications of COVID-19 outbreaks in development and humanitarian settings.

PREVIOUS ARTICLE

Taking steps towards greater diversity and equity within Kiva →NEXT ARTICLE

How microfinance manages a global pandemic: Lessons from Kiva partners →